Defining DeFi and Traditional Banking

Core Concepts Compared

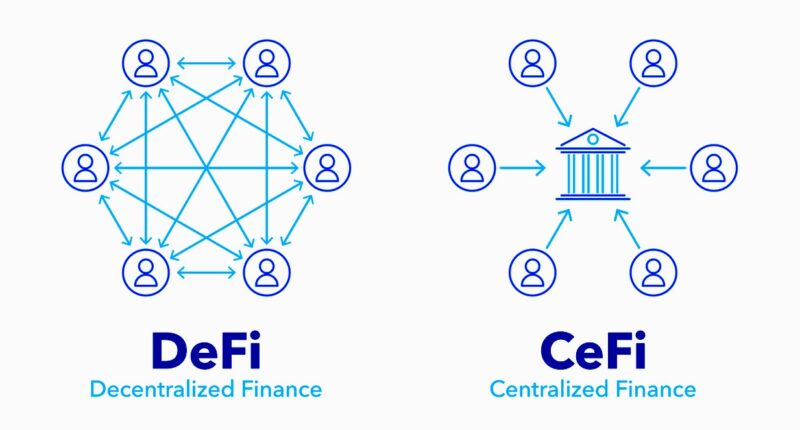

Decentralized Finance (DeFi) leverages blockchain technology to offer financial services like lending, borrowing, and trading without intermediaries, operating on platforms like Ethereum. Traditional banking, in contrast, relies on centralized institutions such as banks and credit unions, managing funds through regulated systems. While DeFi emphasizes user control and transparency, traditional banking prioritizes established infrastructure and regulatory oversight, shaping their distinct approaches to finance.

Accessibility and Inclusion

Openness vs. Gatekeeping

DeFi provides global access to financial services via an internet connection, requiring only a crypto wallet, making it ideal for the unbanked—over 1.4 billion people worldwide, per 2023 World Bank data. Traditional banking often demands identification, credit checks, and physical branches, limiting access in underserved regions. However, DeFi’s lack of KYC (Know Your Customer) requirements can expose users to risks like fraud, unlike banks’ regulated protections.

Cost and Efficiency

Fees and Transaction Speeds

DeFi transactions typically incur lower fees by eliminating middlemen, with platforms like Uniswap charging 0.3% per trade compared to traditional bank fees averaging 1-3% for international transfers. DeFi operates 24/7 with near-instant settlements via smart contracts, while bank transactions, like wire transfers, can take days and face higher costs. Yet, DeFi’s gas fees on networks like Ethereum can spike during congestion, unlike predictable bank charges.

Security and Trust

Decentralization vs. Regulation

DeFi’s decentralized nature reduces reliance on single entities, using blockchain’s immutability to secure transactions—Ethereum’s network has never been hacked at its core. However, smart contract vulnerabilities led to $3.7 billion in DeFi losses in 2022, per Chainalysis. Traditional banks offer FDIC insurance up to $250,000 and fraud protection but are susceptible to centralized failures, like the 2008 financial crisis, impacting millions. Trust in DeFi depends on code audits, while banks rely on regulatory frameworks.

Control and Autonomy

User Empowerment vs. Oversight

DeFi grants users full control over their assets through private keys, enabling direct management without bank approval. Platforms like Aave allow lending or borrowing without credit checks, fostering autonomy. Traditional banking restricts access through account freezes or loan denials based on credit scores, affecting 45% of U.S. applicants in 2023, per Federal Reserve data. However, DeFi’s self-custody risks loss from misplaced keys, unlike banks’ recovery mechanisms.

Future Potential and Challenges

Innovation vs. Stability

DeFi’s open-source ecosystem drives rapid innovation, with over $80 billion locked in DeFi protocols by mid-2025, per DeFiLlama, offering new tools like yield farming. However, regulatory uncertainty and scams pose challenges, with 20% of DeFi projects flagged as risky in 2024. Traditional banking provides stability and consumer protections but lags in innovation, with only 30% of banks offering digital wallets by 2025, per Statista. Both systems face trade-offs between progress and reliability.