Types and Causes of Disruptions

Banking disruptions can range from temporary system outages to severe crises like bank failures or cyberattacks. Causes include technological glitches, natural disasters, financial instability, or digital transformations like fintech competition. For instance, recent U.S. bank failures in 2023, such as Silicon Valley Bank, were triggered by rapid deposit withdrawals and rising interest rates, highlighting vulnerabilities in smaller institutions. These events raise questions about how safe your money is during such turmoil.

Impact on Your Deposits

Access and Safety Concerns

During disruptions, you may face delays accessing your funds, especially in online banking outages or bank runs. In extreme cases, like a bank failure, deposits could be at risk if uninsured. In the U.S., the FDIC insures deposits up to $250,000 per depositor, per bank, ensuring most personal accounts are protected. However, some X posts claim the Dodd-Frank Act allows banks to convert deposits into assets during a collapse, a controversial interpretation not widely supported by regulators, suggesting depositors remain protected under FDIC limits.

Effects of Systemic Crises

Economic Ripple Effects

Systemic banking crises, like the 2007–2008 Global Financial Crisis, can lead to broader economic downturns. Historical data shows non-systemic distress causes moderate output declines, while systemic crises amplify unemployment and economic contraction two to four times over. Tighter lending standards post-crisis, as seen in 2023, can restrict credit for businesses and consumers, slowing growth. Your money’s purchasing power may erode if inflation persists or economic activity stalls, even if deposits remain secure.

Digital Disruptions and Fintech Risks

Neobanks and Cybersecurity Threats

The rise of fintech and neobanks introduces new risks. These digital platforms offer convenience but often lack the scale, trust, or regulatory oversight of traditional banks. Cybersecurity threats, like data breaches or bot attacks, could compromise your accounts. While fintechs enable faster transactions, their reliance on technology makes them vulnerable. Traditional banks, however, are adopting cloud solutions and AI to compete, potentially reducing disruption risks but requiring robust encryption to protect your funds.

Protections and Precautions

Safeguarding Your Money

FDIC insurance in the U.S. and similar schemes globally (e.g., up to €100,000 in the EU) protect most depositors. Keeping funds below insurance limits and spreading across multiple banks minimizes risk. During disruptions, avoid panic withdrawals, as they can worsen bank runs, though some X posts advocate for cash withdrawals in crises, reflecting distrust in banking stability. Monitoring your bank’s health, using strong passwords, and enabling two-factor authentication further secure your money.

Long-Term Implications

Banking Sector Evolution

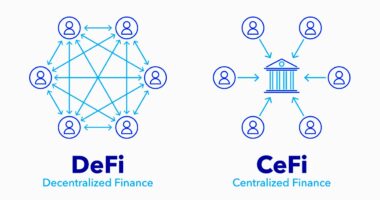

Disruptions often accelerate industry changes, like consolidation or digital transformation. Post-2023 failures, smaller banks may merge, reducing competition but potentially stabilizing the sector. Fintechs and tech giants like Apple or Google could capture market share, offering alternatives but raising concerns about unregulated risks, such as cryptocurrencies’ volatility. Your money’s future accessibility may depend on how banks balance innovation with regulation, ensuring convenience without compromising security.